Deductions from Assignment Rate

Employer Deductions

Margin

Margin is appropriate for the periods being paid

Employer NI contributions

Appropriate rate * Earnings for NI

Apprenticeship Levy

Apprenticeship levy rate * Earnings for NI

Employer Pension

Appropriate rate * Earnings for NI

Holiday Pay

Appropriate rate * Gross Pay

Accrued Holiday Pay

Costs are collected and reported

Expenses

reported and broken down

Agency Paid Expenses

Match the figures reported by the agency

Other Deductions

Are fully itemised and explained

Total Deductions

veriPAYE sum is equal to the reported sum

Employee Deductions

Employee NI contributions

Appropriate rate * Earnings for NI

Income Tax (W1M1)

Appropriate rate * Earnings for Tax

Income Tax (cumulative)

Appropriate rate * Earnings for Tax YTD

Employee Pension

Appropriate rate * Earnings for NI

Accrued Holiday Pay

If post tax retention, appropriate rate * Gross Pay or Net Pay

Student Loans

Appropriate rate based on plan * Earnings for NI

Post Grad Loans

Appropriate rate * Earnings for Ni

Other Deductions

Are fully itemised and explained (e.g. attachment orders)

Total Deductions

veriPAYE sum is equal to the reported sum

Holiday Pay

Holiday Pay when advanced

Appropriate rate * Gross Pay

Holiday Pay calculation

At least 12.07% of Gross pay

In fact many umbrellas will use a larger percentage for accrued holiday calculations to ensure employment costs are covered.

Holiday Pay when accrued

Appropriate rate * Gross Pay plus →

- Employment costs are not being deducted from accrued holiday pay

- Employment costs are retained for when the holiday pay is paid out

- Accrued holiday pay costs pot is fully accounted for

Employee Payment

National Minimum Wage

Checks to ensure the appropriate rate is being paid for the weeks invoiced

Gross Pay

Sum of base pay, bonus, holiday pay and other payments checked against veriPAYE calculation engine

Payment Summary

Gross Pay (Advanced Holiday Pay)

Must equal invoice total – employer deductions and checked against veriPAYE calculation engine

Gross Pay (Advanced Holiday Pay)

Must equal Invoice total + Redeemed holiday pay – employer deductions and checked against veriPAYE calculation engine

Payment Breakdown

Gross Pay must equal base pay, bonus, holiday Pay) and is checked against veriPAYE calculation engine

Payment Breakdown

Gross Pay must equal base pay, bonus, holiday Pay) and is checked against veriPAYE calculation engine

Earnings for Tax

Must equal Gross Pay – Employee Pension (if pension being deducted before tax) and is checked against veriPAYE calculation engine

Net Pay

Must equal Gross Pay – Employee Deductions and be at least NMW and is checked against veriPAYE calculation engine

Total Employee Deductions

Must equal (Deductions + Post Tax Employee Deductions) and be at least NMW and is checked against veriPAYE calculation engine

Statutory Sick Pay

SSP

Statutory Sick Pay is being by the umbrella paid at the correct rate

Employer deductions on SSP

Are being paid by the umbrella at the correct rate

Advanced Holiday pay on SSP

Holiday pay based on the average rate of holiday pay in the previous 52 weeks is being paid (not just on the Statutory Sick Payment)

Accrued Holiday pay on SSP

Holiday pay based on the average rate of holiday pay in the previous 52 weeks is being paid is being accrued (not just on the Statutory Sick Payment)

Employer Pensions on SSP

Are being paid by the umbrella

Earnings for Tax

Must equal Gross Pay – Employee Pension (if pension being deducted before tax) and is checked against veriPAYE calculation engine

Net Pay

Must equal Gross Pay – Employee Deductions and be at least NMW and is checked against veriPAYE calculation engine

Total Employee Deductions

Must equal (Deductions + Post Tax Employee Deductions) and be at least NMW and is checked against veriPAYE calculation engine

Statutory Maternity & Paternity Pay (SMP/SPP)

SMP/SPP

SMP/SPP is being paid by the umbrella at the correct rate

Employer deductions on SMP/SPP

Are being paid by the umbrella at the correct rate

Advanced Holiday pay on SMP/SSP

Holiday pay based on the average rate of holiday pay in the previous 52 weeks is being paid (not just on the Statutory Sick Payment)

Accrued Holiday pay on SMP/SPP

Holiday pay based on the average rate of holiday pay in the previous 52 weeks is being paid is being accrued (not just on the Statutory Sick Payment)

Employer Pensions on SMP/SSP

Are being paid by the umbrella

RTI Checks

RTI Payment checks

- Employer NI matches RTI report

- Employee NI matches RTI report

- Income Tax matches RTI report

- Student loans matches RTI report

- Post Grad loans matches RTI report

- Earnings for NI matches RTI report

- Earnings for Tax matches RTI report

- Net pay matches RTI report

- Take home pay matches RTI report

Pension Checks

Pension checks

- Employee Pension payments match the figures in the (Nest) Pension report

- Employee Pension payments match the figures in the (Nest) Pension report

Standing with HMRC

RTI Payment checks

- Figures in each payment record within the RTI are matched against the appropriate payslip report

- Consolidated figures match total figure reported to HMRC

- Amount actually paid to HMRC matches figures reported to HMRC

- Amount actually paid to HMRC is made timeously

- The umbrella’s over all HMRC accounts for PAYE are in good standing

- Earnings for NI matches RTI report

- Earnings for Tax matches RTI report

- Net pay matches RTI report

- Take home pay matches RTI report

Standing with Pension provider

Pension Payment checks

- Figures reported in the Pension report are matched against the figures reported in the Payslip report

- Employee Pension payments match the figures in the (Nest) Pension report

- Employer Pension payments match the figures in the (Nest) Pension report

Agency Intermediary Reporting (where provided to veriPAYE)

Agency Intermediary Reporting (where provided to veriPAYE)

Figures reported in the agency reporting report are matched against invoice figures in the payslips for the period

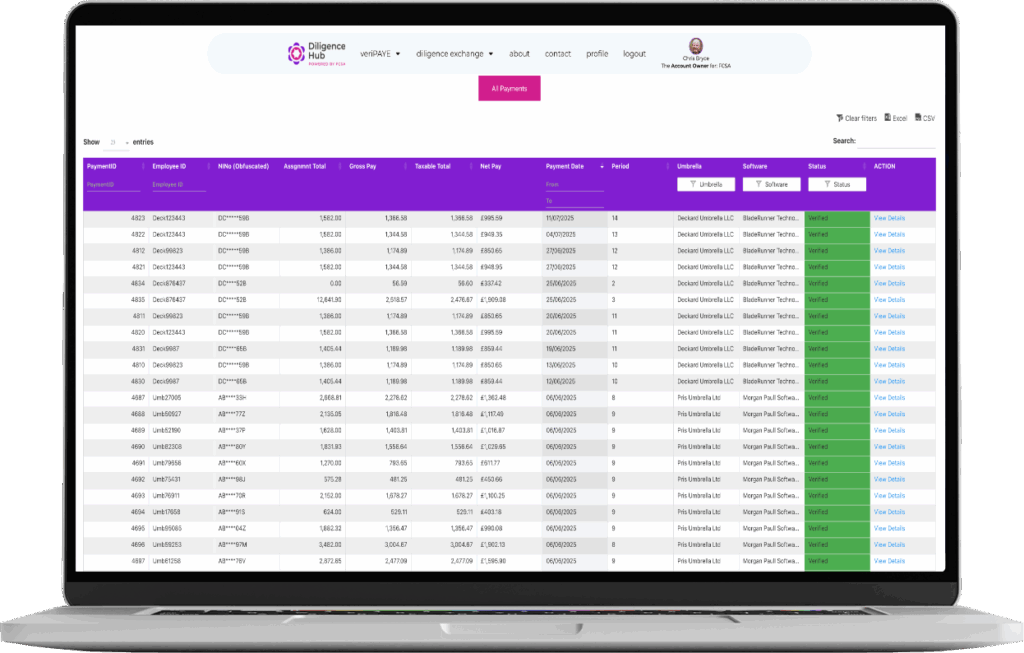

The Payment Listing

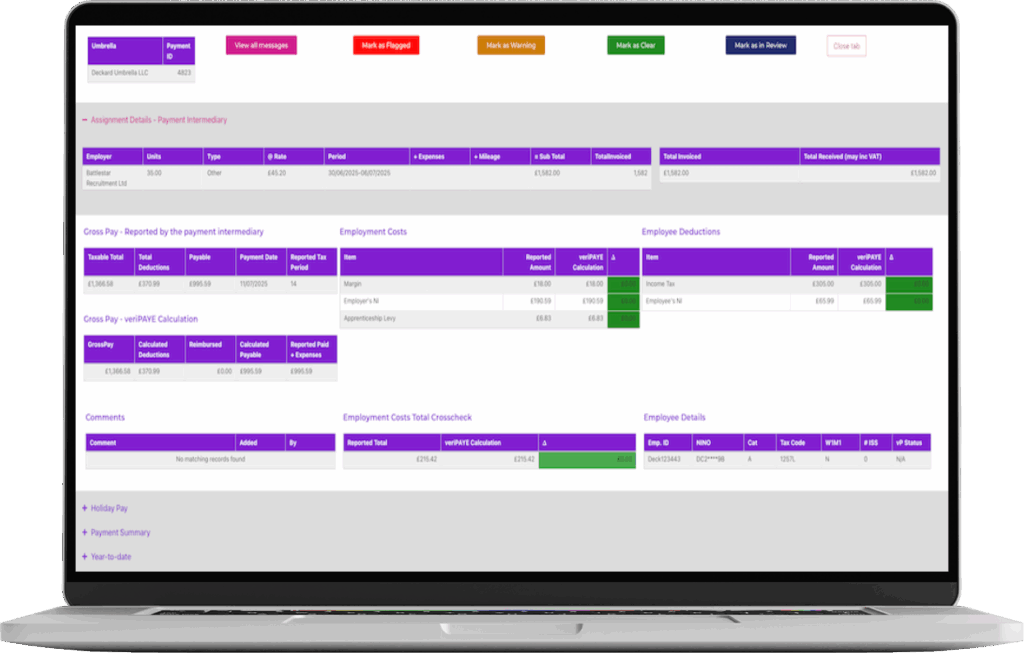

The Payment Details

Payment Intermediaries

Reports are available in your console and by weekly or monthly email

- Figures in each payment record within the RTI are matched against the appropriate payslip report

- Consolidated figures match total figure reported to HMRC

- Amount actually paid to HMRC matches figures reported to HMRC

- Amount actually paid to HMRC is made timeously

- The umbrella’s over all HMRC accounts for PAYE are in good standing

- Earnings for NI matches RTI report

- Earnings for Tax matches RTI report

- Net pay matches RTI report

- Take home pay matches RTI report

Recruiters and End-hirers

Reports are available in your console and by weekly or monthly email

- Figures in each payment record within the RTI are matched against the appropriate payslip report

- Consolidated figures match total figure reported to HMRC

- Amount actually paid to HMRC matches figures reported to HMRC

- Amount actually paid to HMRC is made timeously

- The umbrella’s over all HMRC accounts for PAYE are in good standing

- Earnings for NI matches RTI report

- Earnings for Tax matches RTI report

- Net pay matches RTI report

- Take home pay matches RTI report

Verified payments

Verified Payments

Every element of the payment has been verified by the veriPAYE engine and all is in order

Info and warnings

Info and Warnings

There are some aspects of the payment which we need to let payment intermediaries know about, these are normally simple cross-checks such as the payment being for a new employee we haven't seen before or where no pension has been found - we remind you to check if the worker has opted out of a pension arrangement. The payment is otherwise fine.

Systemic problems

Systemic issues

This is where we see a large number of payments with the same issue, for example the National Insurance rate applied is incorrect - this is often simply a system misconfiguration and we warn both software providers and payment intermediaries about these.

Flagged payments

Flagged Payments

There are one or more elements of the payment which are miscalculated or where data is missing and can't be reconciled. These need attention from you. More often than not these payments can be cleared by the FCSA team when corrections or explanations are accepted.

Suspicious activity

Suspicious Activity

veriPAYE also looks at the overall "big picture" for payment intermediary, and sometimes we'll step in and ask for explanations for anomalies. For example if a a great number workers are receiving untaxed expenses, we'd like to understand why.

Fraudulent activity

Fraudulent Activity

If certain activities just can't be explained by a payment intermediary, we reserve the right to immediately suspend further service and, where necessary report such activities directly to the appropriate authorities, including but not limited to HMRC and Action Fraud.

In certain circumstances we will also issue a public warning about the activity in order to protect workers.